Indian mutual fund industry continues its upward trajectory

The Indian mutual fund industry continues its upward trajectory, witnessing a significant rise in assets under management (AUM) and average assets under management (AAUM) in January 2024. According to recent data, the net AUM surged by an impressive 33.11% Year-on-Year (YoY), reaching ₹ 52.74 lakh crore compared to ₹ 39.62 lakh crore in January 2023. This surge marks the highest rise since September 2021, underlining the industry’s resilience and potential amidst evolving market dynamics. (Source: ICRA Analytics Report Mutual Fund Insights January 2024)

This consistent growth trajectory underscores the increasing prominence of mutual funds as a preferred investment avenue for retail and institutional investors alike.

In a line with this industry growth, UTI Asset Management Company (UTI AMC) has been at the forefront of empowering investors through its extensive network of Financial Centers. Strategically located in key cities and towns, UTI AMC’s financial centers serve as vital hubs for investor engagement, financial literacy programs, and customer support services. Leveraging UTI AMC’s expertise and industry insights, these centers empower investors with the knowledge and tools required to make informed investment decisions.

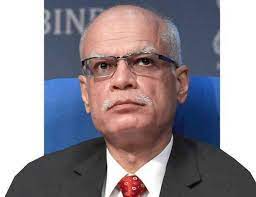

Mr. Anurag Mittal, Head of Fixed Income at UTI AMC, commented on the industry’s growth and UTI AMC’s role in empowering investors, stating, “The remarkable rise in the Indian mutual fund industry’s AUM reflects its resilience and adaptability amidst changing market dynamics. Through its strong presence across India, UTI AMC is committed to empowering investors by providing them with personalized guidance and comprehensive investment solutions.”

The Indian mutual fund industry is looking forward for continued growth, driven by factors such as the country’s youthful demographic profile and increasing financial literacy. The ongoing digitalization efforts are making mutual fund investments more accessible, particularly to individuals residing in smaller towns and cities. Regulatory reforms and investor education initiatives are further enhancing trust and participation in the industry.

UTI AMC has 15 UTI financial centers (UFCs) in West Bengal to endeavor and reach out to its investors through its distribution network.

For Kolkata as a T30 city, the total industry AAUM has grown by 86% from ~ ₹ 1.03 lakh crore in March 2020 to ~ ₹ 1.92 lakh crore in January 2024. The mutual fund growth story in Kolkata has been largely driven by the growth in equity-oriented schemes. The AAUM for equity oriented (including Equity, Hybrid, Arbitrage and Index Equity) schemes has increased from ₹ 45,914 crore in March 2020 to ₹ 1.20 lakh crore in January 2024 – growing 162% in the past 5 years. The rise in investors in the equity-oriented schemes came through the SIP route. The numbers of SIP accounts for equity-oriented schemes rose by 69% over this tenure. (Source: CAMS, KFintech)

For UTI MF, the AAUM for Kolkata increased by 88% from ₹ 3,205 crore in March 2020 to ₹ 6,013 crore in January 2024. The major factor to this growth can be attributed to equity-oriented SIPs in the region, particularly in liquid schemes which indicated a rise of 143% from March 2020 to January 2024. (Source: CAMS, KFintech)